Will Bitcoin win and foster a new renaissance? Part II

How Bitcoin´s paradigm shift clashes with gigantic vested interests. Will this affect its adoption? It can either propel Bitcoin into hyperdrive or kick it into oblivion.

Part II

In Part I I have examined how the fiat money system is rigged. How it has been constructed as a tool for debt bondage and rent extraction and how it is controlled by and benefits to the banking elites (which control the issuance of money) and their vassals (which benefit from the Cantillon effect). The rest of society is a victim of that system. Bitcoin works and it is indeed an alternative to the fiat system. I have closed the Part I noting however that Bitcoin adoption/real time monetization is paved with obstacles, and some look very hard to overcome.

In this Part II I will evaluate which are the obstacles and I will identify the key steps to its continued adoption.

If we assume that Bitcoin can technically scale (it has already through its secondary layer Lightning), then we have to ask where its adoption will come from? How it will be monetized? Slowly then suddenly? Is Bitcoin inevitable? Is Bitcoin for everyone?

We are “prisoners” in a closely guarded financial system and switching to a fully decentralized parallel one is not easy and unfortunately it is also NOT for everyone. Let's see.

Do not count on that for adoption

First, tick off the guardians of the fiat system, the oligarchs and their political lackeys, for the reasons I have mentioned in Part I. And that does not make adoption - i.e. monetization - anything easier. Because hundreds of US$ trillions have no incentive to move into a parallel system that cannot be controlled. At least not until the castle of sand they've built starts crumbling down. When I hear bitcoiners praise Blackrock`s attempts to launch a bitcoin ETF, I shiver. This will bring nothing in terms of real adoption. Speculation, financialization, yes of course.

But the truth is that they are willing to exert some form of control over it. They know they cannot control the Bitcoin with the "B", but they know they can play with bitcoin´s price to achieve the desired results. Do not forget what are Blackrock´s vested interests and therefore their incentives. What money is behind them. To whom belongs such moneys. Why should they themselves feed and grow the Leviathan which will end up destroying their precious elitist fiat system?

Financialization is a net negative for bitcoin. It is the biggest threat.

Bitcoin financialization means:

1. Diluted demand for the real bitcoin, the non-custodial, bearer, decentralized, censorship resistant asset. Money will rather flow into the black hole of derivative financial products and in the weak hands of over leveraged custodians. Anyone FTX & Co.?

2. Discourages self-custody and financial responsibility. You are not your own bank. You are not financially independent.

3. Discourages learning about Bitcoin and becoming financially literate.

4. It is very risky. You will buy nothing else than counterparty risk. You will own nothing but a claim on a claim.

5. Censorship resistance is gone and the intermediaries can easily enforce third party claims or government/judicial dictats on your "paper" bitcoin claim via the intermediaries.

6. It encourages speculation, manipulation and discourages true adoption (i.e bitcoin real time monetization). Indeed, there are many ways to speculate and manipulate bitcoin prices. But Blackrock and Co. sit on another league. Think about their massive fiat firepower and how they can leverage that against an absolutely scarce asset like bitcoin. A pump and dump scheme engineered by Blackrock & Co can kick Bitcoin adoption into oblivion. What about pumping it to 100,000 and then crash it to 1,000? Think they cannot do it?

Once more, be aware of who they are and what incentives they have.

The regulatory threat

Since they appoint the politicians, they also write the rules of the game. And the rules of the game can be changed on a whim to slow down bitcoin adoption. How?

Easy. Forget about the hyped Travel Rule, KYC, AML etc. Despite those being a nuisance, they mainly impact the privacy sphere, and there are still multiple ways around it anyway.

What can really slow down adoption is bitcoin taxation. Just think about having to report your bitcoin stash at the beginning of the year and then pay an inflated capital gains tax on every transaction. They can implement that at global level through the OECD just like the CRS (Common Reporting Standard) and most countries will force bitcoin exchanges to comply. Now that can dramatically slow down adoption. And please do not tell me that the smart ones find ways around it, move their tax residency or buy bitcoin P2P without KYC. The point is that for mass adoption this will be a big red flashing light. Just having to deal with this bureaucratic mess will discourage most people.

De-dollarization is hype

Second, tick off the BRICS and the de-dollarization hype.

To replace the US$ as a reserve currency, you would need to have the replacement currency. No other fiat currency has the market depth the US$ has. The replacement simply does not exist. Nor it exists a country which is willing to be the buyer of the world running enormous deficits. Nor, among the BRICS candidates, exist a country with fully open capital markets. China, the only reasonable candidate, still applies strict capital controls. So, as Daniel Lacalle says here, the challenge to the US$ dominance can only come from an independent global currency. Maybe Bitcoin?

Just wait a second, Daniel.

If you have gone through this list with the names of the WEF Global Leaders, you may have noticed that Russian President Putin graduated from the 1993 WEF class together with former German Chancellor Merkel. That was after Putin left his secret services career and entered the administration of Saint Petersburg Mayor Sobchak, just before pursuing his own political career.

This tells you a number of things about Putin and his handling of the sanctions and of the BRICS future monetary strategy. Putin and the Russian elites do not want to kill the fiat system, not even when that system is predominantly US$ based and has weaponized the western banking rails to sanction Russia. BRICS de-dollarization is all political posturing for the masses. If the sanctions were a vital issue for Russia they could have instantly switched to bitcoin to evade sanctions. But they did not. Elites are elites. Even when at war with each other, they find ways to accommodate their needs behind the curtain. Russia strengthened its business relations with China and the BRICS partners, and the sanctions proved to have very little effects on Russia. The BRICS are working ways to reduce their dependency on the US$ and its banking rails, but they still want to use their fiat currencies. All they need is a mutually convenient settlement mechanism, likely based on some commodities (gold or oil), but certainly not on bitcoin. Bottom line is that also the BRICS and most governments worldwide want to hold tight onto the fiat based monetary system, for it grants their elites domestically the very same “exorbitant privilege” that it grants globally to the US$ and the globalists. Gradually they will reduce the dependence on the weaponized US$, but they will never put at risk the survival of the global fiat system.

Decentralized money is anathema for any political regime which craves control.

So, if a monetary reset will inevitably come sooner or later, what are they going to use to liquify a collapsing system crushed by a mountain of fiat debt?

More fiat of course.

The globo-parasitic elites will most likely try to camouflage the transition to a new monetary system by selling the "same old". For instance, using the SDRs as an anchor for central banks´debt worldwide. This time, the objective will be a truly global fiat currency.

However, this is just a variation of the same old fiat Ponzi scheme we have today. There is a chance though that gold might be included in the basket. After all this is the only real asset the biggest central banks still own.

Bitcoin is not for everyone

Third, tick off a substantial portion of the population cause Blockstream´s Fernando Nikolic is right, Bitcoin is not for everyone.

There are two aspects to it. First, not everyone has the mindset nor the mental opening to question and challenge its biases and education and view it all through a pair of new laser eyes. Therefore, it is more likely that Bitcoin adoption will come "slowly but gradually", until network effects kick-in and then make it "suddenly". Likely it will come in patches, concentrated in close-knit communities and mostly where Bitcoin has a real life use case. Mainly developing countries chronically affected by high inflationary bursts and very weak fiat currencies. Or western ex-democracies quickly morphing into dystopian-Orwellian police-state nightmares.

The second is the degree of user-friendliness. Sure the improvements have been massive and much more will come in the future. But still.

The point is that for mass adoption to happen, there is massive need for apps and protocols which natively use bitcoin/Lightning on the background.

Hyperbitcoinization is a chimera

Fourth, tick hyperbitcoinization off as well for now. So what's left to realistically foster Bitcoin adoption and its real-time monetization? To paraphrase "Bitcoin is Venice" authors: how a global, sound, programmable, open source, digital asset would be monetized from absolute zero?

What`s left for adoption then?

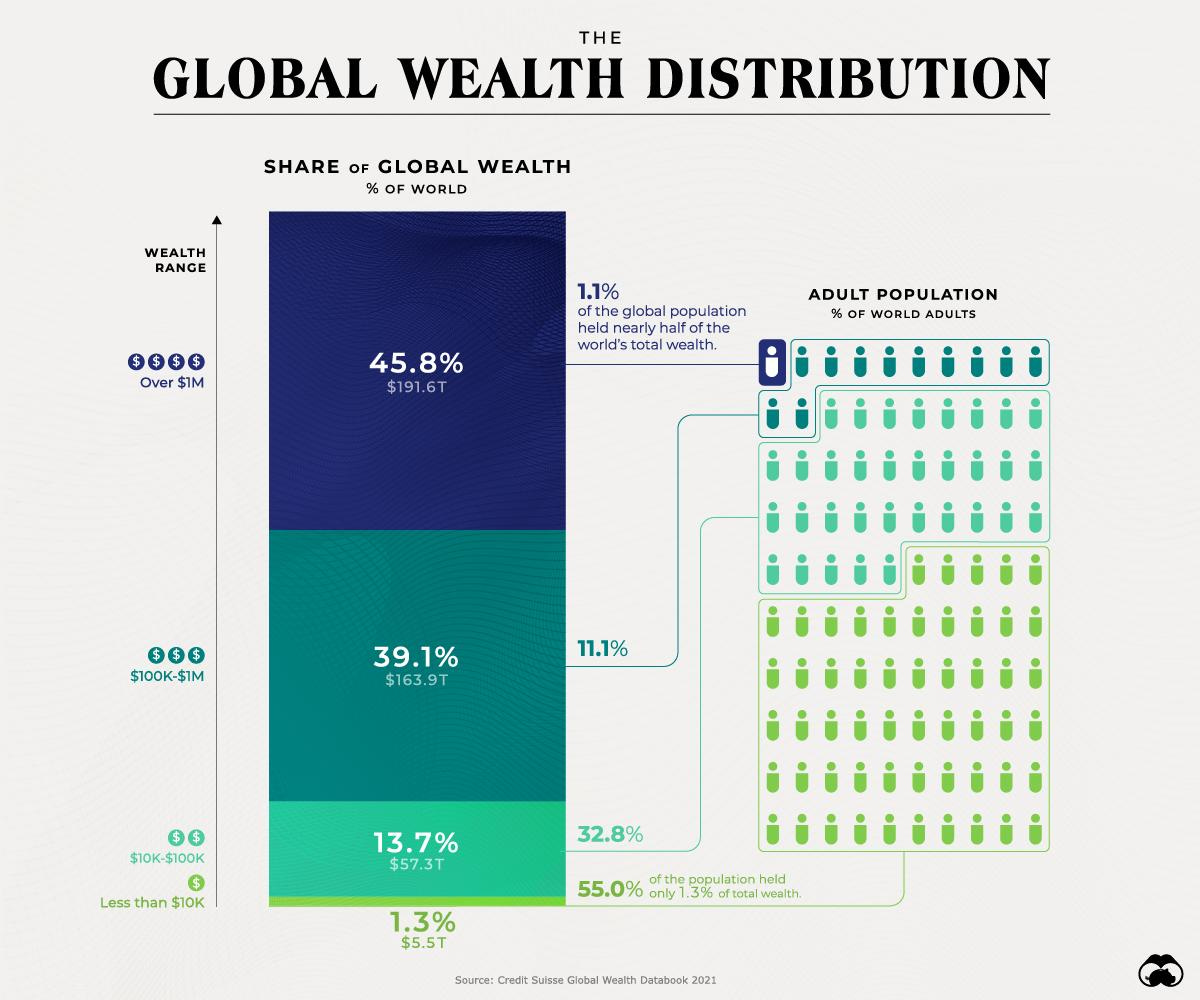

Even though the wealth distribution is clearly not in our favor - since 1% of the wealthiest population holds 46% of global wealth - the numbers are. We still are the 99% and we hold 54% of global wealth. That is plenty to successfully do an economic spin-off into the parallel Bitcoin based system.

All it is needed is a steady growth rate of people and businesses using Bitcoin. The BTC map tells us where we are now in terms of business adoption. Still pretty low so far, but it is gradually growing. Network effects will kick-in once a critical level is reached. Reflexivity theory also applies. From there on, the adoption and monetization of bitcoin can get exponential. Eventually, this will force the rest of the wealth which is now confined within the fiat rails to opt-in the Bitcoin system. In theory, this could be a generational process lasting several decades. Or it can be much quicker. There are too many factors at play which can turn the tables pretty rapidly. Thus, leaving aside impossible forecasts, let's rather concentrate on the steps required to increase adoption and monetize bitcoin:

- adoption from the bottom up is the key, not top-down financialization. Communities of users must flourish in your area. Local small businesses are key to start developing a strong local economy in which local suppliers/products are preferred over global chains. Deglobalization will help Bitcoin flourish. Eventually the user based economy will grow and network effects will kick in.

- Apps and protocols which natively use bitcoin in the background will be key to adoption. Like Strike or Nostr for example. Such apps and protocols will make the transition seamless for the majority of people. Remember that Bitcoin is not for everyone also in terms of user-friendliness. Thus, for most people, the ease of use - just like a credit card or loading up credits into the mobile phone - will be critical. Forget the Bitcoin rabbit-hole, forget what money is, forget Austrian Economics. The masses have to be enabled to use Lightning and Bitcoin without even knowing it, in the background, just like they use the mobile phone. They should not care to know what is behind the client screen...so far it works flawlessly.

- Seamless conversion between bitcoin and crypto fiat - such as USDT or USDC - are also key factors. At least initially, until the bitcoin based economy has scaled up to a certain level. The reason being that it is pretty clear from the usage in countries such as Argentina that for ease of use, as well as for their mindset, people do favor the crypto dollar to bitcoin. For this reason, it is important that people make the initial transition from a failed fiat currency (such as the Argentine Peso or the Turkish Lira) to the crypto dollar as a comparatively safer option. The transition to bitcoin will come later, but it will be much easier having people already familiarized themselves with crypto dollars.

- growing the number of small independent countries which can join the Bitcoin peaceful revolution will also be critical in the adoption process. Switzerland and El Salvador are the prime examples, but also larger economies, which from time to time suffer from destructive inflationary bursts. Argentina, Turkey, Venezuela are all places where bitcoin is already used and will grow more.

- then local municipalities like Lugano in Switzerland and more independent federated States like Texas, Florida or Wyoming in the US. They can all play a leading role in the adoption process.

- and finally, the wild cards. The biggest wild card is the USA. Traditionally, freedom values, both economical and societal, have been ingrained in the American society. This makes America the biggest candidate for large scale Bitcoin adoption. The current polarization of the American society clearly shows the divide between those who still cherish such values and those who have hijacked political and economic power, steering the country towards a self-destructive "leftist-woke-parasitic-crony capitalist" agenda, very much dictated by the same elites mentioned in Part I of this article. But all this can really turn on a dime if the Americans show the determination to take back the destiny into their hands. The next US Presidential elections will be key. Note that there are already three Presidential candidates openly supporting Bitcoin, such as DeSantis, RFKjr, and Ramaswamy.

Then there are a number of additional wild cards. I would put into this group any country in which the vested interest of the elites are quickly driving the country towards a dystopian-Orwellian future, reduced basic rights and liberties, increased surveillance, CBDCs and social credits systems. In all such countries - where the elites seem to be able to manipulate the hypnotized masses to a certain degree- things can get wild pretty quickly if people start raising their heads, opting-out and using Bitcoin. The EU is among them. For the situation in the EU is not yet so much compromised - but civil liberties are quickly being eroded with one excuse or the other - the people may still wake up in time and force a change in the path. And Bitcoin is the easiest escape route and the most effective way to peacefully neutralize and radically change the wrong incentives which keep the fiat system alive.

Summing up

Since this was a fairly long article divided in two parts, a recap is useful.

1. The fiat money system is rigged. It is a system of debt bondage for the masses and a rent extracting mechanism controlled and benefiting the banking elites (which control the issuance of money) and their vassals (which benefit from the Cantillon effect). All the rest of society is a victim of that system.

2. Bitcoin works. It is an alternative to the fiat system. But its adoption is paved with obstacles:

- the guardians of the fiat system represent 1% of the population but hold almost 50% of global wealth and have no incentive in changing a system purposely rigged in their favor. Quite to the contrary, they will use their enormous wealth and political power to oppose that.

- Bitcoin financialization (ETFs or other bitcoin "paper" derivative products) are in general a net negative for adoption.

- De-dollarization is hype and currently does not affect Bitcoin adoption

- Bitcoin is not for everyone because of its relatively lower user-friendliness and because it strongly challenges ingrained cultural/educational biases in people.

- Hyperbitcoinization, is still a Chimera.

3. A realistic long term adoption will be likely "slow and gradual" and might consist of the following steps:

- bottom up adoption by close-knit communities.

- masses will adopt Bitcoin via apps and protocols like Strike and Nostr, not knowing what is behind the screen insofar it works seamlessly.

- small independent countries like Switzerland and El Salvador will be key to bottom up adoption and larger countries suffering from high inflationary bursts.

- Municipalities (like Lugano in Switzerland) and independent federated states will be key (Texas, Florida, Wyoming, etc).

- wild cards are the USA - for its tradition of freedom values, both economical and societal - and any country in which the vested interest of the elites are quickly driving the country towards a dystopian-Orwellian future with reduced basic rights and liberties, increased surveillance, CBDCs and social credits systems. Here Bitcoin can be the tool that people use to take back their basic rights and economic freedom.

4. How long it will take is anyone's guess. In theory, this is a multi-generational transition which can take decades. Or things can escalate pretty quickly depending on many factors impossible to forecast. Reflexivity theory and network effects will play a crucial role.

Conclusion

One word of caution though before closing. Bitcoin is not "inevitable". Despite it being the best money available to humanity, despite the protocol being "antifragile" and shaped strongly in an adversarial environment, bitcoiners are still fragile. We are the weak link in the paradigm shift which Bitcoin fosters.

Humans have always caused the greatest disasters and sufferance in the eternal quest for money and power. The fact that Bitcoin is "a peaceful revolution" does not mean that those holding the keys to this monetary system will accept "peacefully" the revolution. Satoshi understood this all too well at the inception. What Satoshi, whoever he/she was, gave to humanity in 2008 is a splendid technological gift. A Jocker-card which humanity can play to finally turn a game which has been rigged against us since time immemorial. It was never possible before in human history. Maybe this time the outcome of the monetary freedom revolution will be different. Maybe the tables will turn.

Or maybe not.

Be humble, always think in adversarial terms and be ready for a long fight.